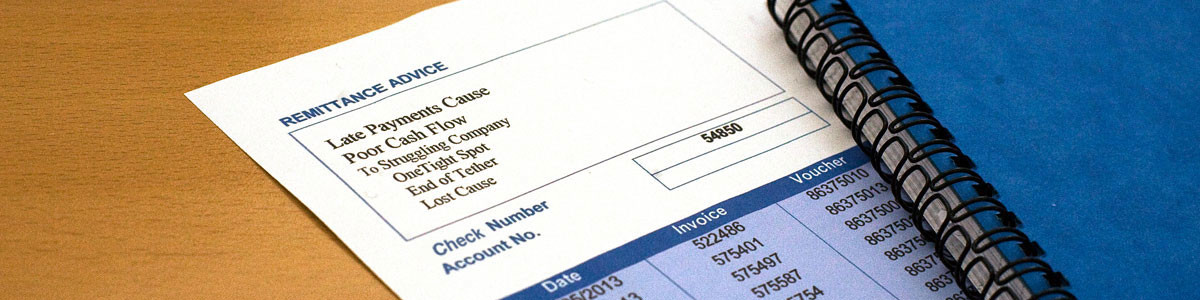

End-to-end image-based platforms to automate the processing of remittance documents across various payment applications.

Processing remittance documents is a key aspect of maintaining cash flow, improving customer service, generating recurring revenue and reducing overall costs associated with processing payments. It is in integral and vital part of all organizations whether you are a financial institution, insurance entity, non-profit organization, government entity or private or public corporation.

Creditron ItemAge Express (IAX) solution offers a feature rich turnkey solution, integrating advanced imaging, data recognition and electronic payment technologies to drive increased operations and IT performance while enhancing customer service. Utilizing the latest in imaging technology our remittance processing solutions will improve the efficiency of accessing critical payment information.

Built on a flexible, open systems architecture, IAX provides an unparalleled ease of installation, operation, management, and support. We have the features and flexibility to handle the numerous challenges in remittance processing.

System features include: real-time data indexing and image viewing; courtesy and legal amount recognition (CAR/LAR); user-configurable job setup; scalability with support for multiple scanners; check encoding and endorsement; image and data archive and delivery options (fax, email, CD-ROM and Internet); and comprehensive auditing and transaction reporting. Our remittance solution also can output images in X9.37 format for Check 21 compatibility and provide Accounts Receivable Check (ARC) Conversion.

The enterprise-class power, reliability, scalability and low cost of ownership is suited for a range of payment applications, including:

The enterprise-class power, reliability, scalability and low cost of ownership is suited for a range of payment applications, including:

- Utility/Telco Payment Processing

- Tax/Government License Processing

- Donations Processing

- Subscription/Order Processing

- Mortgage Payment Processing

- Insurance Premium Processing

- Parking Ticket Processing

- Property Management/HOA Payment Processing

With a feature-rich, scalable and flexible design and numerous optional modules, a Creditron solution is designed to meet both current and future business requirements.

Key Benefits

- Accelerate funds availability

- Reduce bank transaction fees

- Automate exception handling

- Real time dashboard for management of end to end process

- Eliminate the storage of paper copies

- Enhance customer service

- Streamline payment inquiries

- Reduce manual keying

- Eliminate the need to separate the check from the remittance advice (virtual

check separation)